The energy industry is set to suffer a record drop in investment due to the coronavirus fallout, the IEA said, and while renewables are likely to fare better than oil, any swift economic recovery could create a global fuel crunch.

In its annual report on energy investments, the Paris-based International Energy Agency (IEA) estimated the plunge will be of the order of one-fifth from 2019 levels, or almost 400 billion dollars, as firms slash spending amid slumping demand for energy.

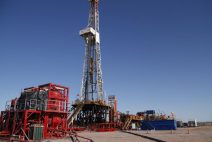

Shale oil producers that catapulted the United States to the world's top crude nation stand to suffer the worst decline, the IEA said.

"All the energy sectors -- oil, gas, renewables -- everything is affected but the biggest impact is on shale oil," the agency's director Fatih Birol told AFP in an interview.

"Total oil investments we expect to decline one third this year whereas the shale industry will see a decline of about 50 percent."

However, spending in renewable power projects is expected to fall by only around 10 percent for the year, the report said. "Even though this 'clean' spending is set to dip in 2020, its share in total energy investment is set to rise," it noted.

But it noted "these investment levels remain far short of what would be required to put the world on a more sustainable pathway," estimating that spending on renewable power would need to double by the late 2020s.