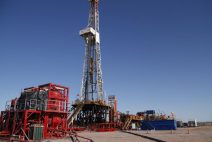

OPEC crude output cuts should help US shale profits in 2021

In top two U.S. shale fields, oil and gas companies are profitable in the $30 per barrel to low $40s per barrel range, according to data firm Rystad Energy. This year’s higher prices could push the shale group’s cash from operations up by 32%, Rystad said