IEA expects a balanced market despite tensions in Middle East

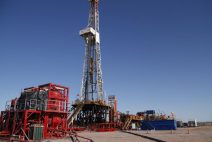

The global oil market is expected to move toward a mid-term balance, despite ongoing geopolitical tensions in the Middle East, as supply increases and demand growth slows, the International Energy Agency (IEA) said